Stock Analysis

- United States

- /

- Software

- /

- NasdaqGS:CIFR

3 High Insider Ownership Growth Companies With Earnings Expansion Up To 132%

Reviewed by Sasha Jovanovic

Following a period of losses, U.S. stocks showed resilience with the S&P 500 closing higher on Monday, as investors shift their focus to upcoming earnings reports from major companies. This renewed interest in corporate performance highlights the importance of understanding factors like insider ownership and earnings growth potential in selecting stocks during uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Growth Rating |

| PDD Holdings (NasdaqGS:PDD) | 33.6% | ★★★★★★ |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 28.6% | ★★★★★★ |

| Li Auto (NasdaqGS:LI) | 31.3% | ★★★★★★ |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | ★★★★★★ |

| Alkami Technology (NasdaqGS:ALKT) | 14.4% | ★★★★★★ |

| Cipher Mining (NasdaqGS:CIFR) | 19.6% | ★★★★★★ |

| Carlyle Group (NasdaqGS:CG) | 27.3% | ★★★★★★ |

| Establishment Labs Holdings (NasdaqCM:ESTA) | 11.2% | ★★★★★★ |

| BBB Foods (NYSE:TBBB) | 23.8% | ★★★★★★ |

| EHang Holdings (NasdaqGM:EH) | 33% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc., along with its subsidiaries, functions as a digital asset technology company in the United States, with a market capitalization of approximately $779.77 million.

Operations: The company generates revenue primarily from digital currency mining, which amounted to $69.23 million.

Insider Ownership: 20.9%

Earnings Growth Forecast: 132.9% p.a.

TeraWulf, trading 84.9% below its estimated fair value, is poised for substantial growth with earnings expected to increase significantly. Despite recent shareholder dilution and a volatile share price, the company's revenue growth forecast at 49.7% annually surpasses the US market average. Recent actions include repaying US$30.1 million of debt and expanding share authorization to support growth initiatives, aligning with its strategic goals to enhance infrastructure capacity significantly by 2025.

- Navigate through the intricacies of TeraWulf with our comprehensive analyst estimates report here.

-

Our valuation report here indicates TeraWulf may be undervalued.

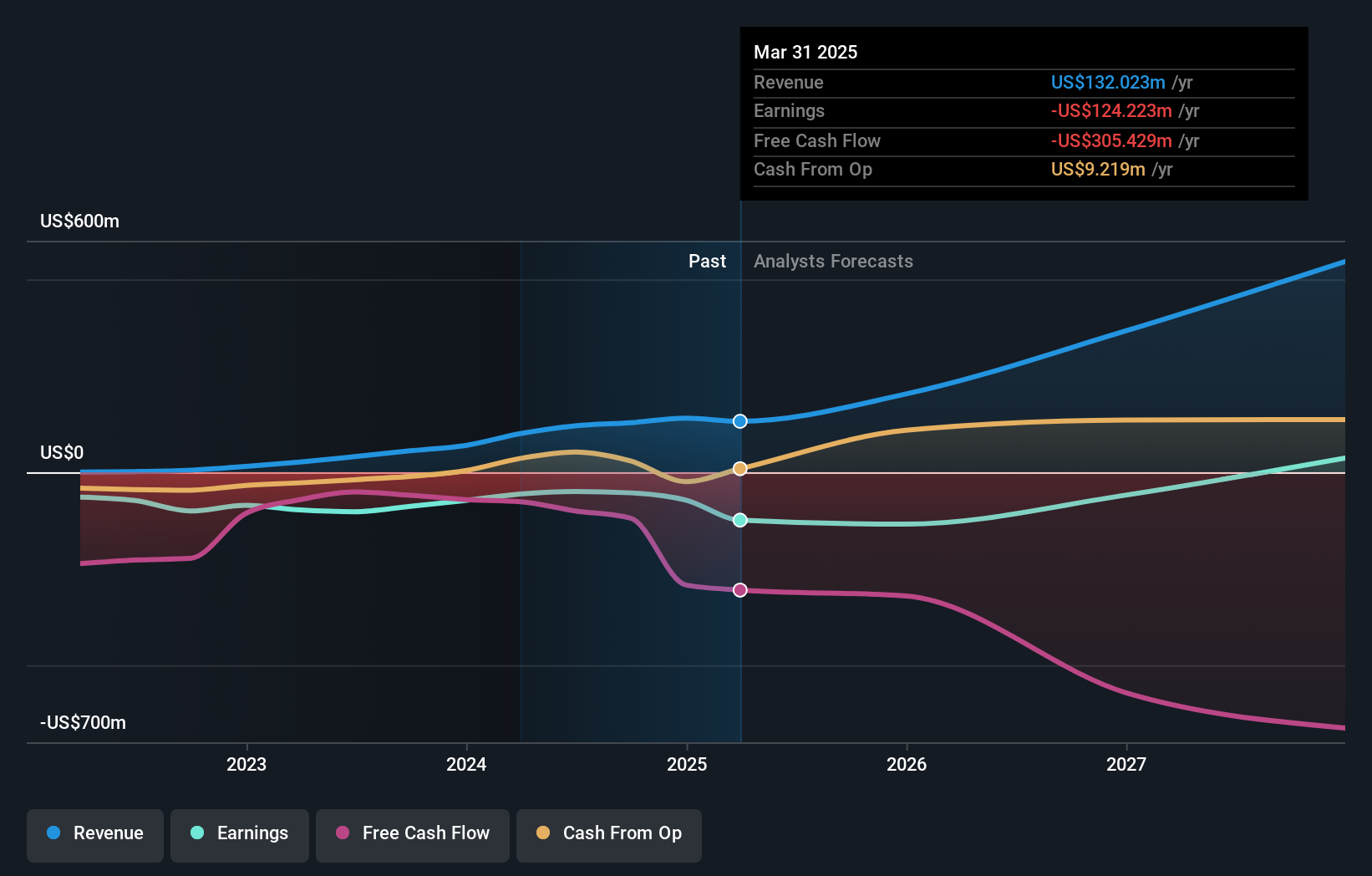

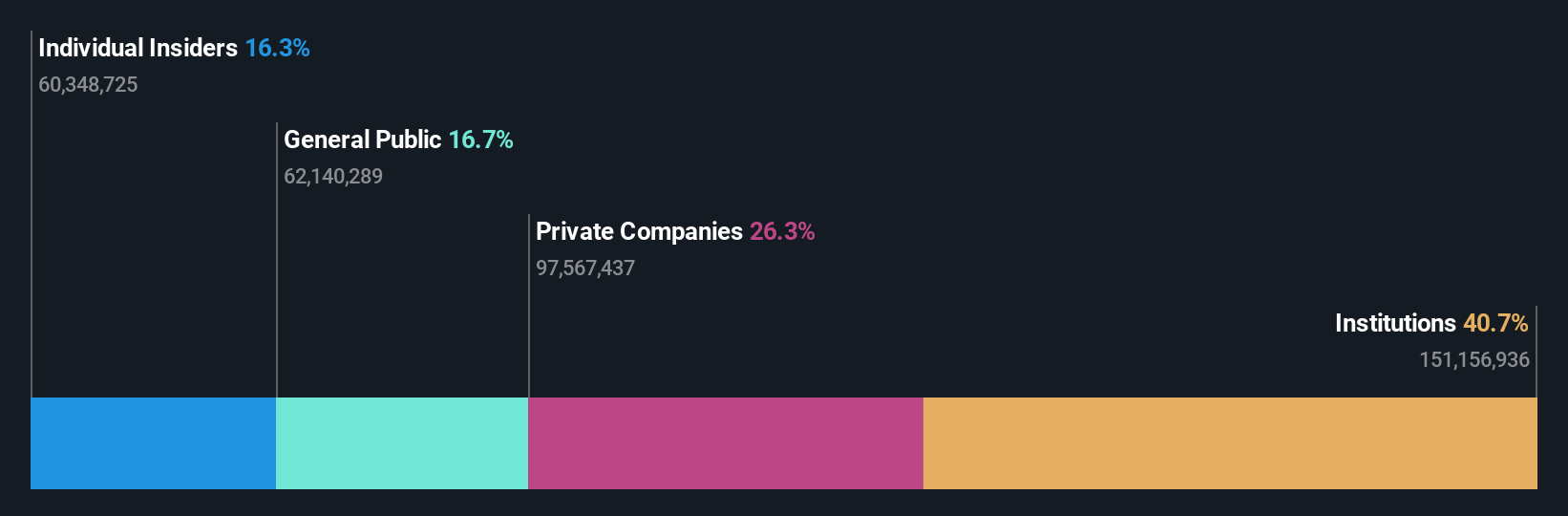

Cipher Mining (NasdaqGS:CIFR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cipher Mining Inc. operates large-scale bitcoin mining data centers in the United States and has a market capitalization of approximately $1.33 billion.

Operations: The company generates its revenue primarily from software and programming, totaling approximately $126.84 million.

Insider Ownership: 19.6%

Earnings Growth Forecast: 75% p.a.

Cipher Mining, significantly undervalued at 76.5% below its estimated fair value, is on a trajectory to profitability within three years, outpacing average market growth expectations. Despite facing shareholder dilution and possessing less than a year of cash runway, the company's revenue has surged by an impressive rate over the past year and is projected to grow at 35.5% annually. Recent operational results include producing 316 BTC in March 2024, with ongoing adjustments in treasury management evidenced by the sale of 8 BTC.

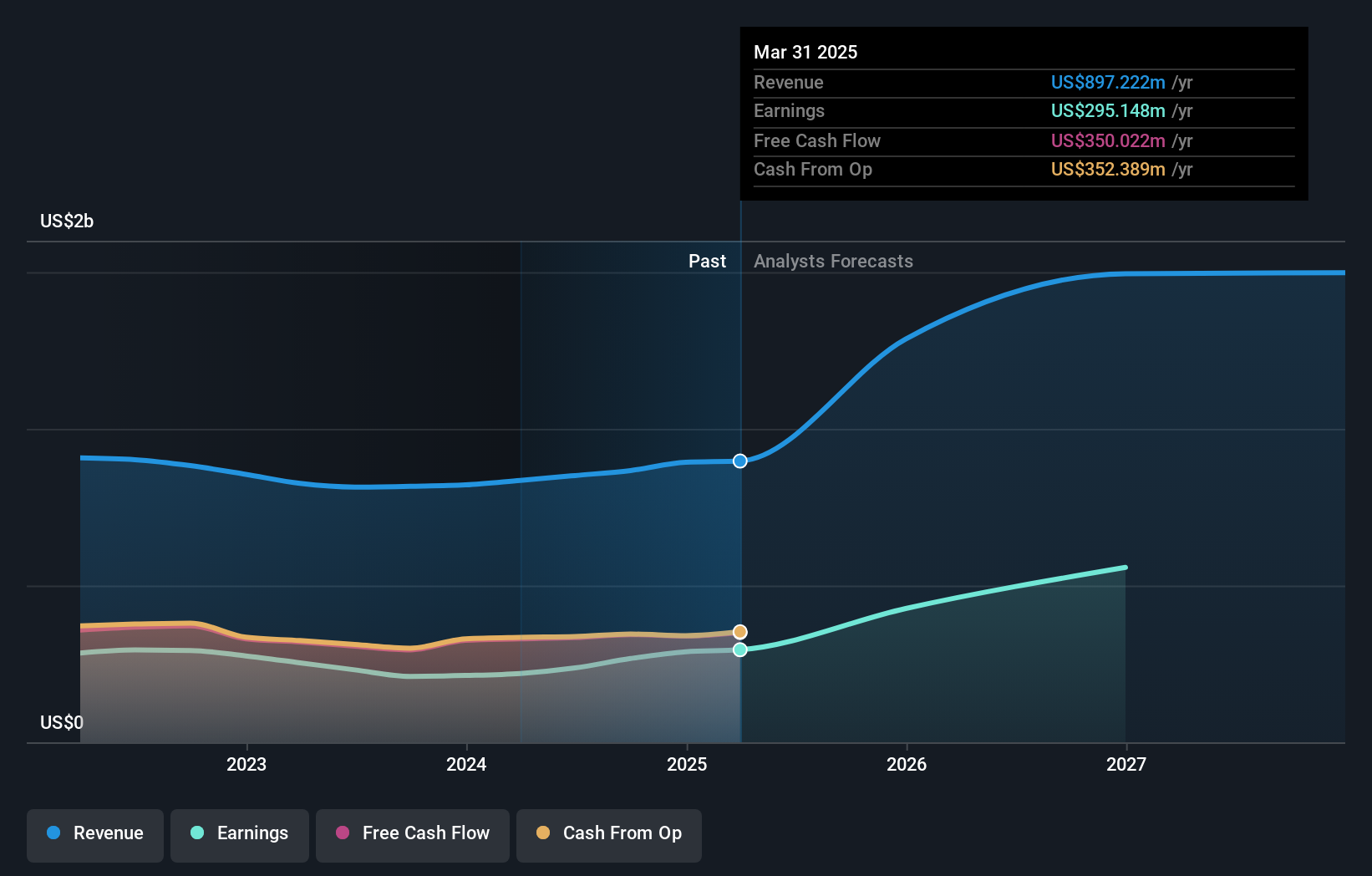

Victory Capital Holdings (NasdaqGS:VCTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Victory Capital Holdings, Inc. operates globally as an asset management firm, with a market capitalization of approximately $3.15 billion.

Operations: The firm generates revenue primarily through providing investment management services and products, totaling $821.03 million.

Insider Ownership: 12.1%

Earnings Growth Forecast: 28.1% p.a.

Victory Capital, a diversified asset management firm with US$175 billion in client assets, recently announced a strategic alliance with Amundi, integrating Amundi US into its operations. This move not only increases Victory Capital's scale and diversifies its investment capabilities but also makes Amundi a significant shareholder, enhancing global distribution potential. Despite high debt levels and unstable dividend records, the company is positioned for substantial growth with forecasted earnings growth of 28.1% annually, outpacing the US market average of 14.4%.

Key Takeaways

- Dive into all 135 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Valuation is complex, but we're helping make it simple.

Find out whether Cipher Mining is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Sasha Jovanovic

Sasha is an Equity Analyst at Simply Wall St with 15 years financial markets experience. He is a CFA Charterholder and holds Bachelor degrees in Mathematics and International Studies from the University of Technology, Sydney, Australia. He worked at CommSec Investment Management as an Investment Analyst from 2014 and later at Sequoia Financial Group as a Portfolio Analyst from 2018.

About NasdaqGS:CIFR

Cipher Mining

Engages in the development and operation of industrial scale bitcoin mining data centers in the United States.

Flawless balance sheet and fair value.