Key Takeaways

- Amazon’s earnings power is much higher than its reported profits - driven by 3P sellers, Advertising and AWS

- More growth to come from best-in-class customer experience, cross-selling and industry growth trends

- Continued reinvestment will suppress short to medium-term cash flows and hide profitability

- Operating leverage will drive revenue growth higher than fixed cost growth, and operating margins will increase.

- That growth will come from Online retail (and 3P), Cloud computing and advertising revenues

Catalysts

Business Catalysts

Refocusing On The Core Businesses And Opportunities Will Improve Profitability

Andrew Jassy’s 2nd shareholder letter from the 2022 annual report outlined the fact that Amazon is choosing to refocus on the core businesses and opportunities that they have long term conviction in. For long term shareholders, this is great to hear.

From optimising the fulfillment centres networks from a national model to a regional model (with 8 interconnected regional centres rather than 1 national centre, which is less centralised and brings less complexity for fulfillment), to closing initiatives that they don’t believe are long term opportunities (including their bookstores, 4 Star stores, Amazon fabric, Amazon care, and some newer devices) and letting go of 27,000 corporate roles, the company is refocusing on its core opportunities.

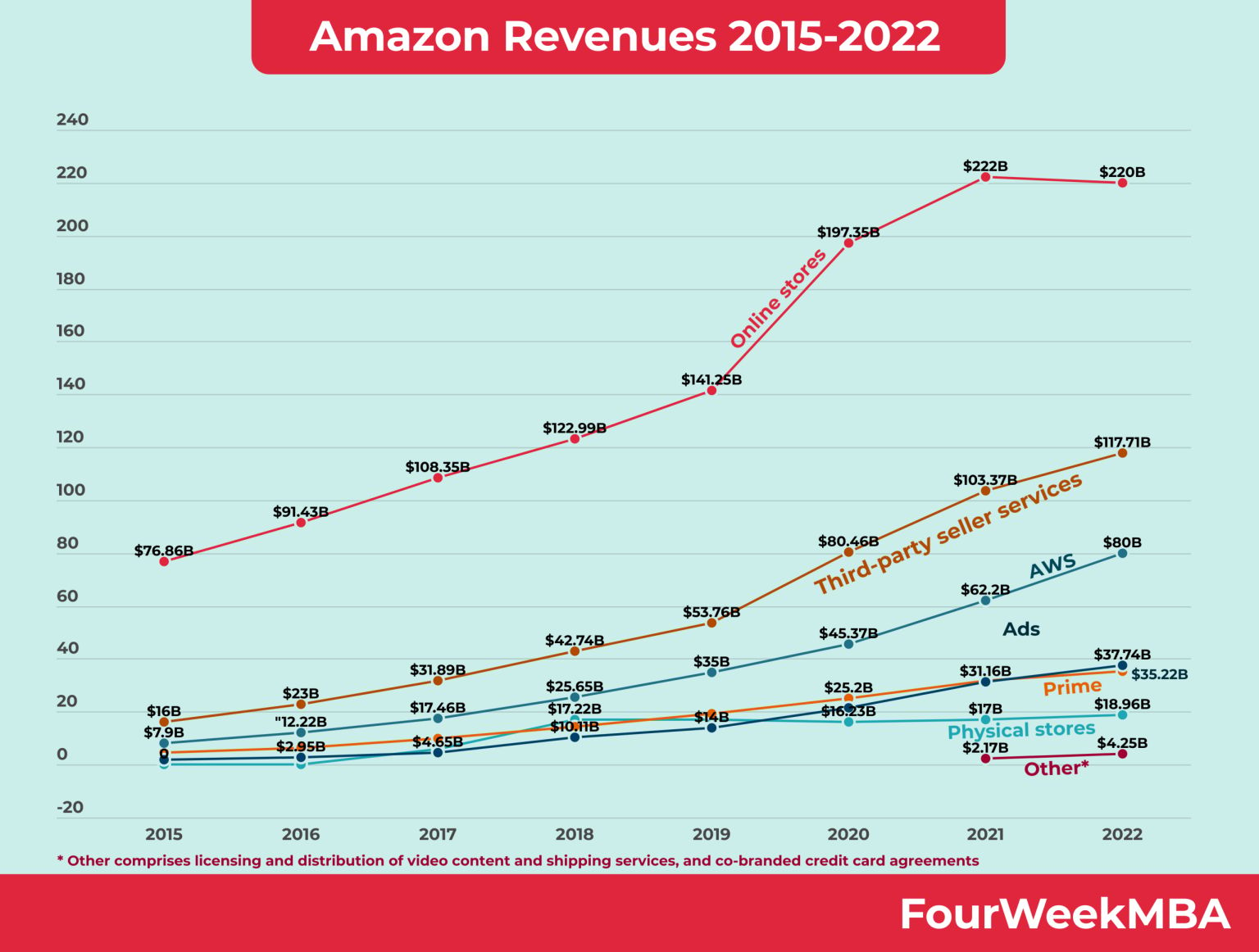

Source: FourWeekMBA

For context, Amazon has 6 main revenue streams, 3 of which contribute most to its profitability. The 6 streams, from highest to lowest revenue contribution, are:

(all growth figures are from for the 2 year period from Dec 31 2020 - Dec 31 2022)

- Online stores (43% of revenue - growing at 5.5%),

- Third-party sellers (23% of revenue - growing at 21%)

- AWS (15% of revenue - growing at 32%)

- Advertising (7% of revenue - growing at 38%)

- Subscription services (7% of revenue - growing at 18% )

- Physical stores (4% of revenue - growing at 8%)

- Other (1% of revenue - growing at 58%)

The biggest revenue and profit contributions (and opportunities) are from its Third-Party Seller ecosystem, AWS and its Advertising business. I’ll delve into the catalysts for each below.

Its Online Retail Dominance Will Continue

Amazon’s decades worth of investment to lower costs, reduce delivery times, and build a meaningfully larger retail business with healthy operating margins is not slowing down anytime soon.

This long term vision has helped it build an online retail behemoth, and a third-party selling platform with enviable traits.

The company has invested huge amounts of capital over the years to build out its fulfillment network in the USA, and it’s now in the optimisation phase there (at least for now). As for international markets, it's continuing to invest heavily to gain the same sort of dominance.

Annual revenue from its consumer business grew at a rapid clip over 2019-2021 from $245bn to $434bn, which drove the need to double its fulfillment network that it had built over 25 years, and substantially accelerate the last mile delivery service (which is now the size of UPS).

It did this in the span of 2 years, and as you can imagine, capacity to handle orders was the key, while efficiency and optimisation were secondary priorities. This investment in infrastructure has solidified its leadership position.

The key point here is that Amazon’s online retail store and the third party seller platform are the go to choice for consumers looking to buy, and businesses looking to sell.

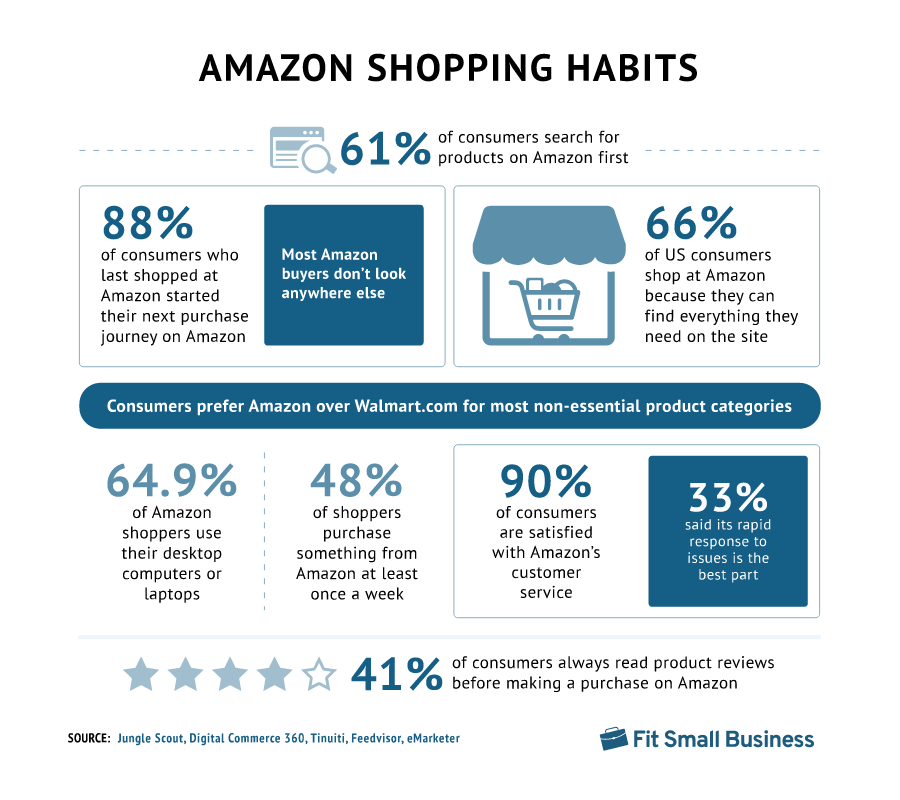

Source: FitSmallBusiness

For consumers, it’s hard to find the same experience that Amazon delivers with regards to choice, prices and speed of delivery. That is a moat that would require hundreds of billions of investment and decades to replicate for their online platform and the service customers receive.

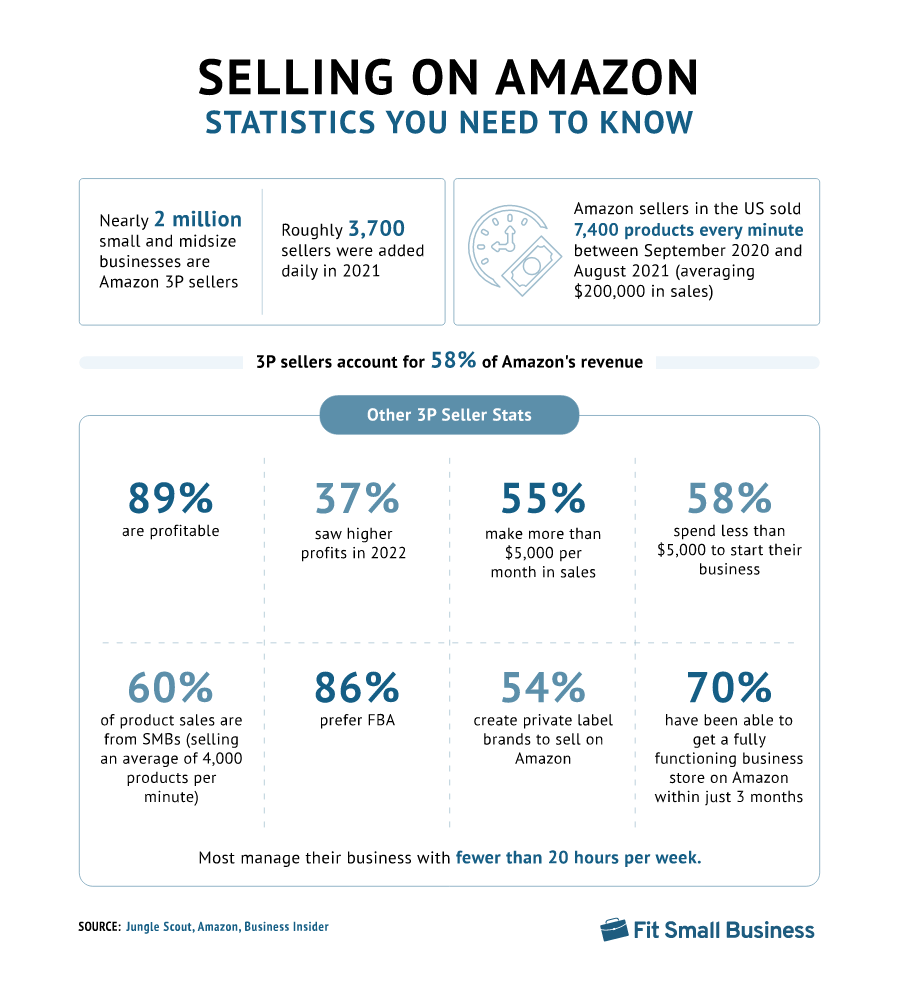

Then for the third party seller platform, the Fulfillment By Amazon (FBA) service, as well as the pure scale of the audience on the platform make it hard to justify selling your good elsewhere without paying much higher costs per sale for the same service, or without having to invest a lot upfront.

Reports (1,2,3) indicate that Amazon sellers pay anywhere from 35% to 65% of their revenue per item sold to Amazon which is made up of a 15% referral fee, a 20-35% FBA fee (depending on size, weight and the sellers business model), and up to 15% in advertising costs per sale.

If you were to try and set up your own shop with storage, fulfillment, delivery services, and advertising, nothing on the market can match the prices that Amazon can deliver to third party sellers (depending on the scale of their operation).

Source: FitSmallBusiness

While Amazon might grow slower in its home market of the USA, it is establishing itself in global markets and seeing promising signs in international markets.

The compounded annual growth over 2019-2021 in the UK, Germany and Japan was 30%, 26% and 21% respectively.

Over the past several years, the company has been making investments in regions such as India, Brazil, Mexico, Australia, various European countries, the Middle East, and parts of Africa to start to build similar networks in these regions.

While these will require lots of initial investment up front to get going and to reach scale, they are reportedly on similar trajectories to what their more developed markets are experiencing.

The opportunity, globally, for Amazon to continue growing its online retail presence and dominance, is underpinned by 2 main factors: its industry leading customer experience, and the global secular trend of online retail growing as a portion of total retail sales.

Simply put, online retail has been, and will continue to grow as a portion of total retail sales and its still only a small portion. Roughly 80% of all global retail sales are still in physical stores, but this number has been decreasing incrementally each year as ecommerce grows.

That is a natural tide that lifts retail part of the businesses prospects, which already delivers $434bn in total merchandise value, and two thirds (66%) of Amazon’s revenues.

AWS Will Hit Short Term Headwinds, But The Favourable Long Term Prospects Remain.

The concept of “Cloud Computing” was originally pursued by Amazon in 2003, and they then launched Amazon Web Services (AWS) in 2006. The set of technology infrastructure services they created in the cloud was not obvious to others at the time as a business opportunity, but that bet has helped Amazon get years ahead of the competition.

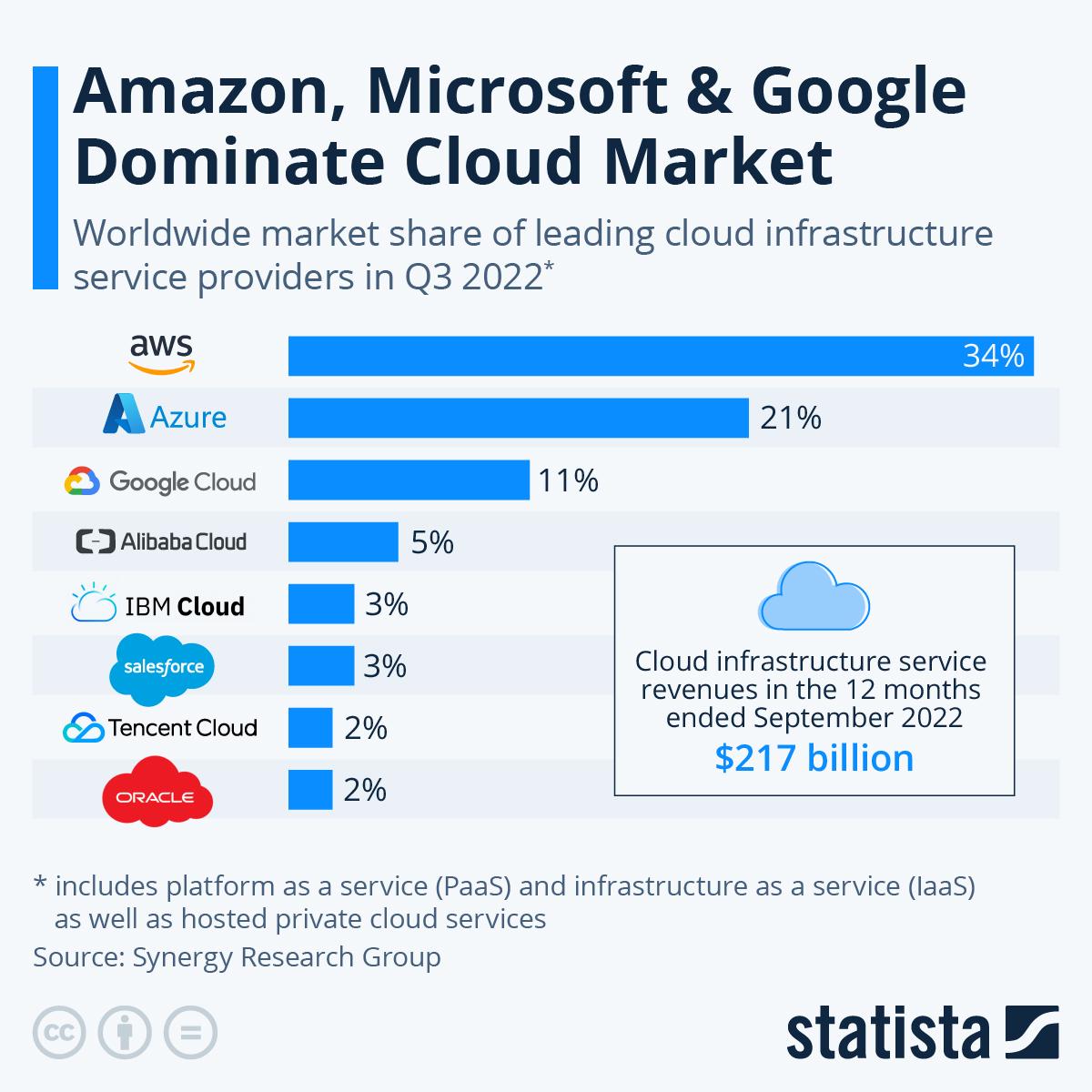

Similar to nailing ecommerce space, AWS is the market leader in cloud computing, with a reported 32% market share (With MSFT’s Azure at 23% and Google Cloud at 10%). AWS is, in their own words “the most comprehensive and broadly adopted cloud offering, with over 200 fully featured services from data centres globally”.

Source: The Trusted Tech Team / Statista

The company is constantly adding new features within each service, with 3,300 features added within those 200 services in 2022 alone.

Amazon is taking the same customer-centric and long-term approach to AWS as it is does with any other part of its business, and this will likely stand it in good stead to continue innovating and driving efficiencies in the space that drive better results for customers and then ultimately, shareholders.

This in turn will likely lead it to attaining more customers when they finally choose to move their businesses or operations to the cloud (or even migrate from other less customer centric cloud providers).

During this slowdown where businesses are more conscious of their IT spend given the current macroeconomic environment, Amazon is working with clients to optimise costs and helping them reduce unnecessary AWS expenditure rather than try to extract every extra dollar out of them.

This will slow the company’s growth rate in the near team, but it is not a fundamental “deterioration”.

It’s a short term headwind, where longer term, this relationship focus and customer obsession will contribute to sticky revenues, and place them ahead of competition both in revenues, and reputation.

The two key drivers for AWS’s long term success are similar to its retail business. That is, being best in class, and the general global secular trend of “cloud migration”, where businesses are opting to not manage their own tech infrastructure, and instead opt for the benefits of cloud computing where they get the benefits of agility, cost efficiency and security that it has to offer.

It seems like there’s a long runway of growth ahead. Despite AWS generating $80bn of revenue over 2022, Jassy commented that 90% of Global IT spend is still on-premise.

Expectations are for the Cloud computing market to grow from $450bn in 2022, to $2trn worth in 2032 (16% CAGR). AWS is perfectly positioned to continue benefitting from this theme since there’s still so much untapped market, and its reputation in the space is enviable.

Amazon’s Advertising Is A Hidden Cash Cow

Amazon’s advertising business is little known since it’s not really reported on by the company (just revenues), but it’s a business that is likely generating incredibly high-margin profits for the company.

Just like supermarkets sell shelf space and “end-caps” and placement within their circulars, Amazon’s sponsored products and brands offerings have been within the Amazon ecosystem for more than a decade. Except, Amazon’s advertising offering can be even more accurate due to user segmentations and targeting that we’re familiar with in the online digital advertising space.

Over the last few years it has been picking up serious steam now contributing 7% to overall revenues, the same amount as their subscriptions revenue (mostly Prime).

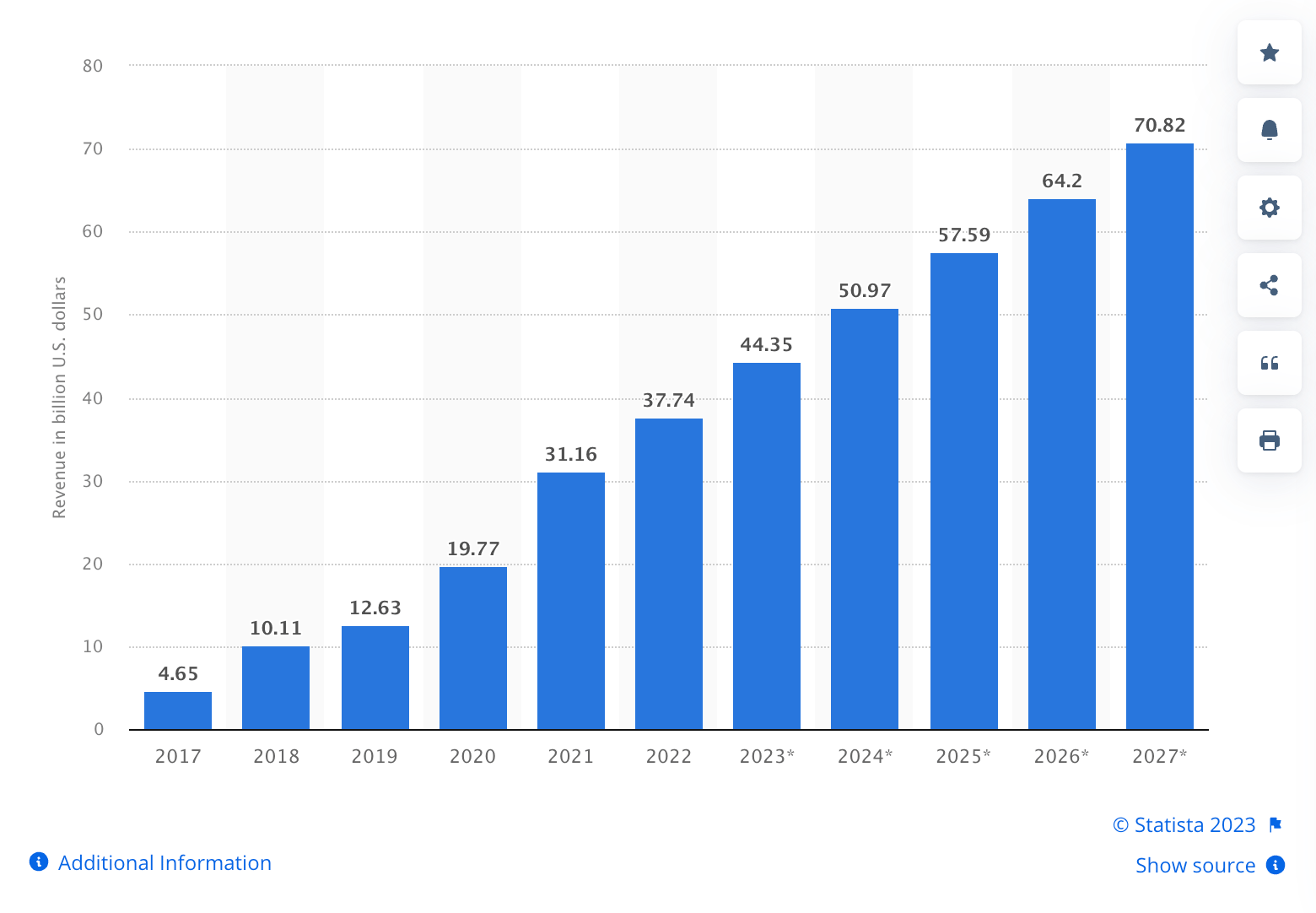

The below chart from Statista shows Amazon's Advertising revenue generated worldwide from 2017 to 2027 (forecasted).

Source: Statista

Many sellers on Amazon acknowledge that advertising on the platform is just a part of running a business on the platform, because otherwise you won’t get noticed. As of 2021, reportedly 75% of the 2 million third party sellers (now 2.5m) on Amazon use the advertising offering in their business, and in that same year, 34% said they intended to increase their ad spend the following year.

Advertising on Amazon is becoming more and more crucial for brands looking to stand out in the ever growing marketplace.

As brands continue their transition to online marketplaces from physical stores, and since the majority of US consumers start their search for products on Amazon, advertising on the platform is becoming a normal part of business for these sellers.

Additionally, feedback from sellers seems to indicate that advertising is worth it, so sellers seem to be getting bang for their buck, for now at least (1, 2, 3).

As for the business side of things, this advertising arm has many strengths. It's growing faster than AWS, has nowhere near the amount of capital expenditure required to run it compared to AWS, and likely has much higher profit margins than Google Services in the sense that it doesn’t have to pay Traffic Acquisition Costs (TAC) that Google has to pay.

While the advertising business contributes only 7% to total revenues, it’s probably safe to assume, based on the above reasons, that it’s running on incredibly high profit margins.

Some believe they’re likely north of 50%, which means it could be generating as much operating profit as AWS. I believe the margins could be even higher, but still, 50% net margins is awesome.

As businesses continue to flock to online marketplaces like Amazon, and seller adoption of advertising continues to grow, it’s likely that the advertising business will continue to do very well into the future.

Assumptions

I’ve made assumptions for each line of revenues, and made estimates on their operating cash flows to estimate a final operating cash flow number that I’ll use in my valuation.

Online Stores Growth To Continue Steadily

- The bread and butter of Amazon. As the global trend of retail continues moving from physical stores to online, I expect Amazon to be well positioned for this, and continue growing its online store sales at around 5% annually for the next 5 years. Meaning, I think revenue from this segment can reach $280bn by 2028.

- I believe this businesses operating margins are likely to be higher than that of Walmart’s (6%) since it doesn’t have as much depreciation or “physical store” costs to contend with (2-3% of Walmart’s sales).

- But to be conservative, I’ll assume it’s operating margins are 5% meaning it would generate operating cash flow from Online stores of $14bn.

Third-party Sellers Revenue To Grow Strongly

- Based on the same industry growth and market leading platform in the online retail space, I believe Amazon will grow its third party seller revenue at 15% per year for the next 5 years (slower than its historical 21% per year growth) to reach $235bn in revenue by 2028.

- Estimates from some analysts out there assumed that Amazon had 20% operating margins on this business in 2018, so while they’re likely slightly higher now, at say 25%, with the last few years of fee increases and gains from operating leverage, I’ll still assume a 20% margin to be a bit more conservative.

- That would give it operating cash flow from 3P sellers of $47bn in 2028.

AWS Growth To Exceed Industry Growth

- I believe AWS growth will moderate in the near term due to macroeconomic conditions and Amazon helping existing AWS customers cut non-critical cloud expenditure (which is AWS' revenues). But over the medium term, I expect revenue growth to pick back up about 25% per year.

- From $80bn this year, I will be conservative and assume that its revenue will grow longer term at 20% per year, well below the 32% historical growth rate, to reach $200bn in revenue by 2028.

- It currently has 28% operating margins, and while I think their margins could increase due to operating leverage, cost reductions in the data centres and increases in overall efficiency in this business, I’ll stick with 28%.

- So 28% operating margins on $200bn in revenue would deliver $56bn in operating cash flow. Since they report this line of business and its profits already in the financial statements, I don’t believe I need to make any adjustments to estimate its operating cash flow, I believe it's reflected fairly in its net profits.

Advertising Growth Will Benefit From 3P Adoption

- As more businesses take up Amazon’s advertising offering, I believe it’s growth will continue strongly into the future. I assume it’ll grow revenues at 25% per year for the next 5 years (down from 38% historical growth), to reach $112bn by 2028.

- As mentioned further up, if we assume the operating margins are somewhere around 50%, that’d result in $56bn in operating cash flow. Basically the same as my estimated AWS profits. (In reality, the operating margins could very well be higher than that, but I’ll stick with this for now).

Subscription Services Growth to Slow And Generate No Profits

- In my view, Prime subscriptions are more of a marketing tool and a loss leader (I assume), driving purchases and loyalty in other areas of the business (building a “switching cost” moat) rather than trying to generate any profits.

- 200m people around the world have a Prime subscription, and if we assume they all pay around $139 per year, that means they contributed roughly $27bn (77%) to the $35bn in revenue from this segment in 2022.

- I assume global Prime subscriptions can get to 278m based mainly on international growth outside the US, and that the average revenue per user will be $159 per year given I expect incremental price increases globally over the next few years like they have previously.

- It’s historically been growing at 18% per year, but I assume it’ll grow at 10% per year for the next 5 years, to reach $56bn in total revenue (with $44bn coming from Prime memberships).

- I assume this segment makes no money, so I’ll assign it a $0 operating cash flow.

Physical Stores Growth To Not Be Meaningful

- Physical stores are a very small portion of Amazon’s revenues, and I don’t believe they’ll be a big growth driver given the company’s renewed focus on core initiatives.

- This growth will mostly rely on more Whole Foods stores being opened, and less of the other physical stores (including Amazon Fresh, Amazon Fabric, etc mentioned earlier).

- Given it’s closed a bunch of physical stores in the last year, I assume revenue growth from this segment will slow down to 5% per year, and grow to $24bn in 2028, from $19bn today.

- Given they probably have similar margins to what Whole Foods had when they were acquired in 2017 (5% net margins), I’ll assign the same now.

- So 5% net operating margins on $24bn in revenue would deliver operating cash flow of $1.2bn in 2028.

Free Cash Flows To Remain Suppressed Until The Opportunity Is “Seized”.

- The reason I haven’t mentioned free cash flow is because the company keeps reinvesting so heavily in these huge opportunities in front of it, that I believe it is not going to generate any meaningful free cash flows that it can retain or distribute to investors in the near term. It would much rather reinvest heavily because the future opportunity is larger than short term distributions it could make in the form of buybacks or dividends.

- This can be explained by how the $46bn operating cash flow that was generated for 2022, was lowered to a -$16bn Free cash flow loss because the “Purchase of Property, Plant and equipment (PPE)” equalled $58bn. The $46bn of operating cash flows shows us how profitable the businesses are, and the $58bn investment in PPE shows us how much they’re reinvesting in growth (which includes software and web development, capital and finance leases and build-to-suit leases on property and equipment).

- According to Brain Olsavsky (the CFO) in the Q4 2021 earnings call, these capital expenditures are reportedly split among infrastructure - 40% (mostly AWS), 30% is fulfillment capacity in regards to warehouses, and then 25% is their transportation capacity, with the remaining 5% being things like offices and stores in other capital areas.

- I assume the vast majority, say 70% ($40bn), of these 2022 annual capital expenditures are GROWTH investments, while the remaining $17bn are MAINTENANCE expenditures. Meaning, if Amazon decided to halt all growth investments, in 2022 it could have generated $24bn in Free cash flow.

- But, since Amazon is focusing on the long term, specifically, customer and revenue growth, the degree to which customers are repeat customers and the strength of the brand (as stated in the 1997 letter to shareholders), they’ll continue to invest aggressively rather than take free cash flows now.

- Their goal is to expand and leverage their customer base, brand and infrastructure to become an enduring franchise long into the future, and given the opportunities ahead, and their historical record of execution, I believe this is the right course of action.

Risks

Regulation Could Prevent Revenue Growth

A company as large and dominant as Amazon is quite familiar with regulators around the world. There are facing plenty of challenges in the court room, but I don’t believe there are any significant threats to their business model, at least ones not significant enough to disrupt its main business drivers.

However, in regions such as Europe and other regions where Amazon is the entrant, local regulators may take decisive action to protect local businesses from being disrupted. This could lower growth prospects, but I believe that Amazon can handle this risks appropriately with its capital allocation decisions and do its due diligence before entering certain markets or investing too much in upfront capital expenditures.

In regards to the possibility of being forced (or choosing to internally) spin off AWS from Amazon, this isn’t a huge risk. History has shown with other spin off situations that often once the spin off occurs, both new businesses are revalued appropriately whereas before the spin off, the “sum of the parts” valuations done by investors often undermine each respective business.

A Prolonged Recession Could Also Lower Revenue Growth

If we go into a long recession, this will no doubt reduce consumer spending (online retail), and businesses will consequently be reducing up their advertising budgets (third party sellers) and IT expenditure wherever they can (AWS). In this case, the growth rates I expect above may not come to fruition, and it may take longer to reach the revenue and earnings figures I believe are possible. While this is a possibility, I don’t view it as a huge risk for now.

How well do narratives help inform your perspective?