Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Investors Appear Satisfied With NVIDIA Corporation's (NASDAQ:NVDA) Prospects As Shares Rocket 25%

NVIDIA Corporation (NASDAQ:NVDA) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 211% in the last year.

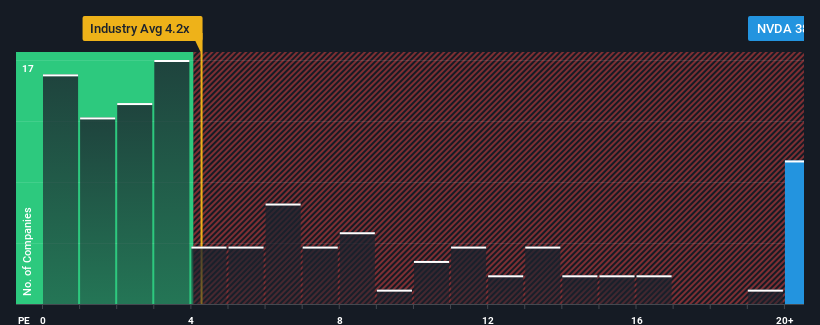

Following the firm bounce in price, NVIDIA may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 38.5x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 4.2x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for NVIDIA

What Does NVIDIA's P/S Mean For Shareholders?

NVIDIA certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NVIDIA.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as NVIDIA's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 126% last year. The latest three year period has also seen an excellent 265% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 40% per year during the coming three years according to the analysts following the company. With the industry only predicted to deliver 29% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why NVIDIA's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does NVIDIA's P/S Mean For Investors?

Shares in NVIDIA have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into NVIDIA shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for NVIDIA that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether NVIDIA is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NVDA

NVIDIA

Provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with outstanding track record.