Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Party Time: Brokers Just Made Major Increases To Their NVIDIA Corporation (NASDAQ:NVDA) Earnings Forecasts

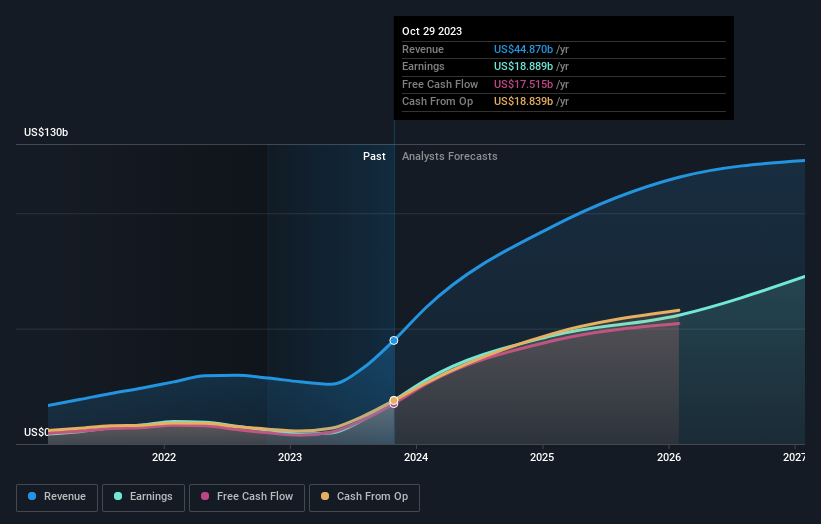

Shareholders in NVIDIA Corporation (NASDAQ:NVDA) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance.

Following the upgrade, the latest consensus from NVIDIA's 53 analysts is for revenues of US$105b in 2025, which would reflect a substantial 133% improvement in sales compared to the last 12 months. Per-share earnings are expected to leap 190% to US$22.21. Prior to this update, the analysts had been forecasting revenues of US$94b and earnings per share (EPS) of US$18.32 in 2025. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

View our latest analysis for NVIDIA

It will come as no surprise to learn that the analysts have increased their price target for NVIDIA 14% to US$802 on the back of these upgrades.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting NVIDIA's growth to accelerate, with the forecast 133% annualised growth to the end of 2025 ranking favourably alongside historical growth of 28% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 17% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect NVIDIA to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, NVIDIA could be worth investigating further.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for NVIDIA going out to 2027, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're helping make it simple.

Find out whether NVIDIA is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NVDA

NVIDIA

Provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with outstanding track record.